By JoAnn Lombardi, President VR Business Brokers/Mergers & Acquisitions

Unforeseen taxes can turn a good M&A transaction bad – and even result in the loss of thousands of dollars for buyers and sellers alike. Before you green-light a deal, consider how you’ll structure it to offset such risks and maximize tax savings.

Unforeseen taxes can turn a good M&A transaction bad – and even result in the loss of thousands of dollars for buyers and sellers alike. Before you green-light a deal, consider how you’ll structure it to offset such risks and maximize tax savings.

Buyers and Sellers Beware

With most acquisitions, either stock or assets are purchased. Buyers typically prefer asset transactions because they allow for a step-up in the target’s basis for tax purposes and help avoid undisclosed tax and other liabilities.

Asset sales also are flexible, allowing buyers to purchase only the parts of the target company they want. And they can provide buyers with a bigger tax write-off. Buyers of depreciable assets can begin reducing their taxes right away by taking the depreciation expense. If, for example, a company pays $10 million to purchase assets with 10 years of remaining life, its taxable income can be reduced by $1 million each year for the next 10, using a straight line depreciation schedule.

Sellers, on the other hand, often prefer stock transactions, because they’re subject to taxation at a relatively low capital gains rate. For sellers structured as C corporations, asset sales can be particularly unfavorable. C corporations are required to pay ordinary income tax on the amount by which the sale price of the assets exceeds their tax basis. What’s more, when money from the sale is distributed as dividends, or the corporation is dissolved, the corporation’s shareholders pay capital gains tax on the distributed money. C corporation sellers, therefore, typically try to negotiate for a stock sale. This way, gains are taxed once at the relatively low long-term capital gains rate of 20%.

Structure the Deal Carefully

The structure of an M&A deal can significantly affect the tax consequences for buyers and sellers. Typically, deals are structured as one of the following types of transactions: Taxable. In this type, the buyer purchases a company’s stock or assets and the company realizes a taxable gain or loss on the transaction.

Tax-deferred. Here, the buyer generally acquires stock or assets in exchange for stock in its own company. There’s no immediate gain or loss to the seller or shareholders. Instead, the shareholders “carry over” their basis in their old stock to the new stock and realize a taxable gain or loss only on a taxable disposition of the new shares.

Hybrid. This reorganization also involves a certain degree of non-qualified deal consideration at the time of the transaction. As such, the transaction may be taxable to some parties but not to others. It may offer flexibility if some of the participants are willing to realize taxes when the deal closes, and others need to defer the taxable event until a later time.

Find Common Ground

Although buyers and sellers have different needs – which often are at odds – financial advisors can help structure a transaction so that it’s amenable to both. Even, for example, when the seller exchanges stock with the buyer, the deal can be structured as a more tax-advantaged asset acquisition by making a Section 338 election.

In this case, the buyer benefits from the step-up in basis on the acquired assets and is able to claim the acquired company’s financial and tax liabilities resulting from the transaction. Although the seller treats any asset sale gains above the tax basis as ordinary income, the bulk of the transaction is likely to be taxed as capital gains. Adjustments in the purchase price can offset the ordinary income amount.

Beware of Tax Traps

Determining the tax implications of a potential deal should occur early – preferably during the due diligence phase. But even if you plan ahead, tax pitfalls lurk. State and local governments assess a varying range of income, sales and transfer taxes, particularly if one or both parties to the transaction do business in multiple states or internationally.

Buyers also should assess the target company’s property tax situation. This includes searching for any liens and requesting proof of payment for the most recent property tax cycle. If the target company isn’t in compliance, buyers risk failing future audits, potentially subjecting themselves to unnecessary tax liabilities. They also should be mindful of a potential property value reassessment – which typically results in a tax increase – after the deal closes.

Even an advantageous M&A transaction can sour if you fail to plan for taxes. But with thorough preparation, buyers can minimize net costs and sellers can maximize after-tax proceeds, resulting in a win-win situation.

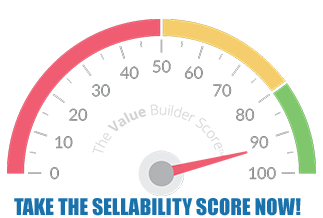

How can you improve the value of your business?

Complete the “Value Builder” questionnaire today in just 13 minutes and we’ll send you a 27-page custom report assessing how well your business is positioned for selling. Take the test now:

By Ryan Jorden, VR Business Brokers – Managing Partner

By Ryan Jorden, VR Business Brokers – Managing Partner

When considering selling your business, every buyer expects a business of great value as an investment. Depending upon the qualified candidate, it could be an entrepreneur with a specific set of needs that motivates them to invest in an established business or it could be a private equity group that sees the benefit in acquiring a business based on their strategy for future growth. Whatever the reasoning might be, the challenge is what can you do to attract the right buyer?

When considering selling your business, every buyer expects a business of great value as an investment. Depending upon the qualified candidate, it could be an entrepreneur with a specific set of needs that motivates them to invest in an established business or it could be a private equity group that sees the benefit in acquiring a business based on their strategy for future growth. Whatever the reasoning might be, the challenge is what can you do to attract the right buyer?