Written by Dani Forman Axial | November 16, 2020

The polarized economic performance of the Consumer industry over the last 9 months has all the makings of a great business school case study.

Where brick and mortar has struggled, e-commerce has thrived. Where travel-oriented businesses have watched their sales all but disappear, producers of home exercise equipment can’t keep up with the sudden and sustained spike in demand. Consumer-focused deal professionals are carefully studying these trends in an effort to predict a return to baseline, what the new baseline will be, and what trends are here to stay.

In this report, we profile 50 top consumer industry private equity investment firms and M&A advisors who are best positioned to advise and capitalize on Covid’s sweeping change to the consumer economy.

We also reveal an analysis of the relative overlap between transactions going to market via Axial and the specific consumer segments most in demand on the platform. The analysis is accompanied by commentary from Axial Members and consumer industry specialists Triangle Capital, Threadstone Advisors, L Catterton, and Camano Capital.

Introduction

Consumer spending habits were already undergoing a major paradigm shift prior to Covid-19. As we’ve seen in other industries, the pandemic has accelerated certain emerging trends by an estimated 5-10 years. As an example, consumers spent $211.5 billion on e-commerce in the second quarter of 2020, up 31.8% quarter-over-quarter according to JP Morgan, citing data from the U.S. Census Bureau.

“Consumers’ minds have shifted,” says co-founder and Partner at Triangle Capital, Richard Kestenbaum. “More people are acting like early adopters, which has accelerated the acceptance of a lot of the digital trends we’re seeing in the consumer space today. That won’t go away. Some consumer habits will return to normal, but some won’t, meaning they are real and enduring.”

Top Consumer Segments in the Lower Middle Market

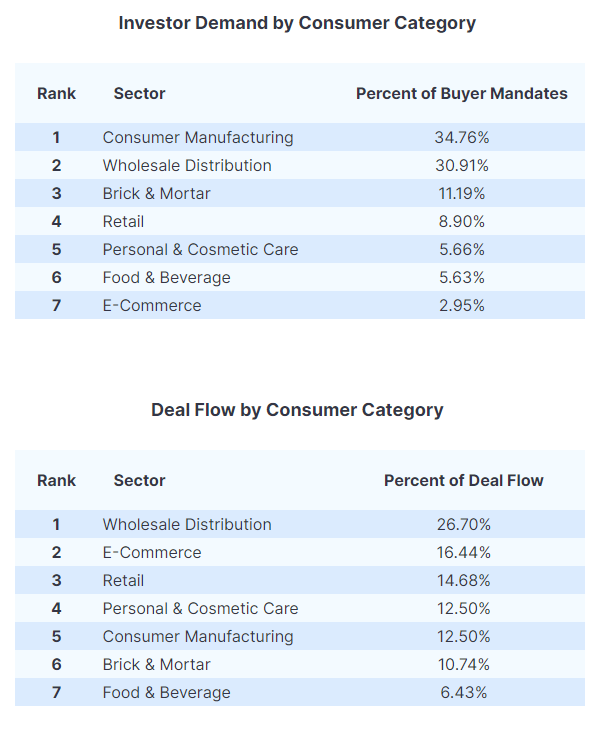

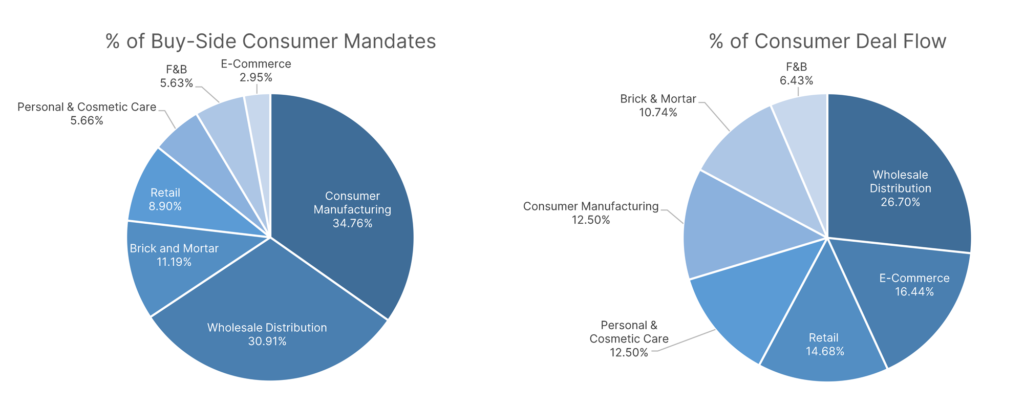

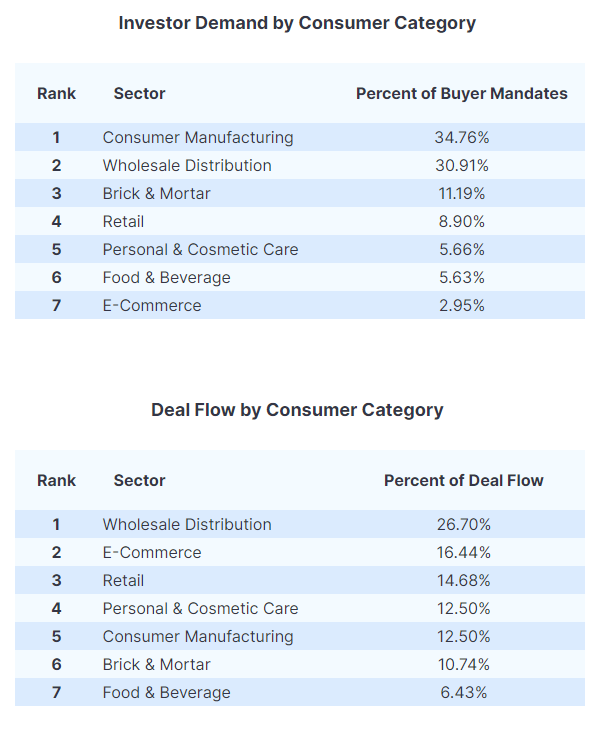

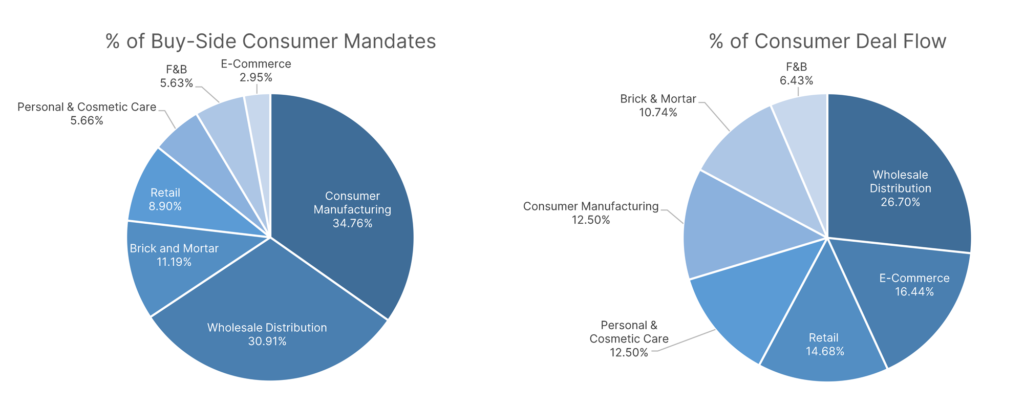

We analyzed the consumer focused investment criteria of over 750 private equity investors and corporate acquirers on Axial and over 1,000 consumer related deals that have come to market in the last 12 months. The analysis yielded the following top 7 lower middle market consumer segments on the buy and sell-side:

Rapidly evolving digital trends within the consumer space, along with a number of Covid-related consolidation opportunities in consumer manufacturing, distribution, and supply chain management, represent a majority of the verticals included within these 7 core-categories.

Retail, E-Commerce, and the Growth of Direct-to-Consumer

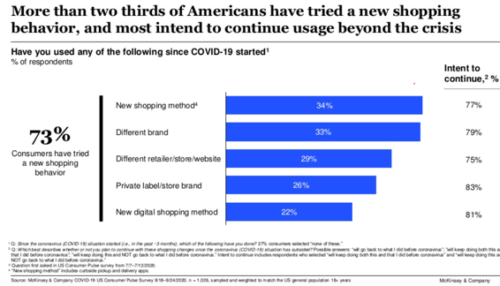

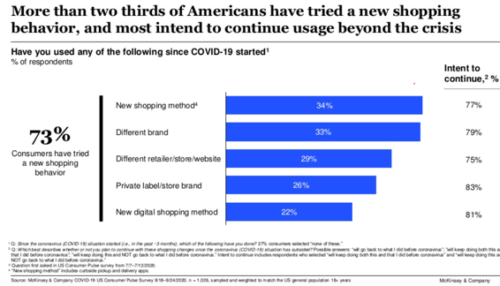

Predicting consumer trends has and always will be the name of the game in consumer M&A. Even those with the strongest intuition have been kept on their toes since the onset of the pandemic. McKinsey’s recent survey of over 2,000 consumers showed that 73% of Americans have tried new shopping behaviors since Covid-19 began.

Predicting consumer trends has and always will be the name of the game in consumer M&A. Even those with the strongest intuition have been kept on their toes since the onset of the pandemic. McKinsey’s recent survey of over 2,000 consumers showed that 73% of Americans have tried new shopping behaviors since Covid-19 began.

“Consumer preferences haven’t changed materially during Covid,” says Harry Fackelmayer, Vice President at L Catterton. “What has changed materially is how those consumers are interacting with, obtaining, and paying for products & services.” One of the most pronounced areas within Consumer that reflects this ever-evolving interaction with products and services is the movement away from traditional retail, towards direct-to-consumer (DTC) offerings.

“To thrive today, a large part of your business needs to be direct-to-consumer, with a real, prominent e-commerce presence,” Fackelmayer points out. Digitally native, DTC brands need to remember amidst the Covid-induced surge in demand, the core tenants that made DTC so appealing (and profitable) to begin with. First, the relatively inexpensive cost of customer acquisition, and second, the gross margins of the product being sold, which experts benchmark at between 50% and 85% for the most successful DTC companies.

Taylor Fish, Partner at Camano Capital has spent a significant amount of time with existing portfolio companies, making sure they’re equipped and ready to capitalize on this push to DTC. “The margin profile and ability to cost-effectively manage your customer base are a few of the things that makes DTC so attractive from an investment profile perspective.” Fish points out that DTC enabled businesses in the lower middle market make especially appealing targets, because “most LMM businesses haven’t yet reached the scale or don’t have the know-how to effectively execute on both e-commerce and retail go to market strategies at the same time. That’s where we can help.”

Retail is Down but not Out for the Count

As we’ve established, there’s reason to believe that the recent spike in e-commerce activity, which has contributed to the proliferation of DTC offerings, will continue for the foreseeable future. The question then becomes, is this the end of retail?

Not by a long shot.

“Almost every square foot of retail space in America is worth less than it was a year ago,” Kestenbaum points out. “That means if I’m a retailer, I can have a bigger store for the same scale of operation than I could have before. What do I do with that extra space?”

Retail businesses that were not instrumented to support e-commerce or DTC prior to March are likely feeling the pain of the recent lockdowns. Those that were and are managing to weather the storm, however, have a real long-term opportunity to capitalize on a growing experiential consumer trend, with more physical space, and less resources, to win the loyalty and attention of a new customer base.

Impact on Retail M&A

Segments of retail M&A were already on the decline for a number of reasons before 2020, dropping 59% since it’s peak in 2016. “I suspect this is the nail in the coffin for a lot of mom and pop retailers who have already been struggling to compete with the Amazon’s and big box retailers of the world,” says Josh Goldberg, Managing Director at Threadstone Advisors. “ Investors are aware of that struggle and are mostly staying away from pure-play brick and mortar retail because of it. Some retailers will recover, but it will take a significant amount of time for investors to see how they respond.”

Segments of retail M&A were already on the decline for a number of reasons before 2020, dropping 59% since it’s peak in 2016. “I suspect this is the nail in the coffin for a lot of mom and pop retailers who have already been struggling to compete with the Amazon’s and big box retailers of the world,” says Josh Goldberg, Managing Director at Threadstone Advisors. “ Investors are aware of that struggle and are mostly staying away from pure-play brick and mortar retail because of it. Some retailers will recover, but it will take a significant amount of time for investors to see how they respond.”

Goldberg continues, “Investors buying into retail and consumer companies today need to think about what’s around the corner. You’re buying based on historical revenue and EBITDA, but you’re buying for future revenue and EBITDA. Explaining the net results of the consumer behavioral shifts from Covid, and what you’re doing to generate additional revenue because you experienced Covid will become an imperative part of the M&A narrative.”

Private Label vs Brands

“Panic buying” – think Charmin toilet paper flying off the shelves in the early days of the pandemic – was a blessing in disguise for private label brands. The consumer rush to buy familiar brands in March and April led to a sudden and severe shortage of those products. Consumers were then forced to buy “store brand” foods, beverages, cleaning products, and personal goods only to realize that they weren’t so bad afterall. A recent study showed that more than 45% of consumers that recently switched to private label products did so first and foremost because the prices were better, followed closely by a “lack of availability of their preferred national brands.”

Now that consumers know there are comparable, cheaper options out there, how much does brand influence the purchase decision making process?

“Brands used to give people more comfort and security than they do now,” says Kestenbaum. “Sustainability, fair wages, and health benefits trump the importance of the brand for today’s consumer. Target is a perfect example of a company who used private label manufacturing to drive more people into their stores. Their value proposition used to be about coming to the store to buy other brands. Now, it’s come to our stores because we make everything ourselves. The prices are fair and the products are better.”

Private label brands from stores like Target have gained popularity at a much faster pace due to the pandemic, but according to a recent study from LEK, this is likely only the beginning. In the beauty and cosmetic sector, 67% of shoppers believe that private label products provide better value for your money. Millennials in particular are evangelizing the move towards off brand products, purchasing at a significantly higher rate of 32% compared with 25% in older age brackets.

While this trend is undeniable, a strong brand is still crucial for many consumer-focused investors. This newfound emphasis on price and values has made smaller, value-based brands prime acquisition targets as a means of insulating larger CPG brands from the consumer preference shift towards private label.

Supply Chain Resilience is Key

The third and final trend we’ll cover in this report stems directly from the migration towards e-commerce/DTC offerings and the increased consumer acceptance of private label products.

At the heart of every successful consumer operation lies a supply chain that manages the flow of goods – from raw material procurement through fulfillment and consumption. The logistical complexities of the supply chain make it extremely prone to inefficiencies – blood in the water for opportunistic investors who can leverage their experience and resources to transform leaky supply chains into opportunity.

The demand shock from Covid-19 exposed pre-existing problems with smaller consumer manufacturing businesses and their overwhelmed supply chains. Investors and larger manufacturers aware of these issues have begun targeting smaller manufacturing operations in hopes of finding discounted opportunities that will also enable them to expand into new product lines, verticals, and geographies.

Aside from the M&A consolidation opportunities, investors have used their portfolio company’s supply chain woes as inspiration to invent and simplify. “An investment in optimizing your supply chain directly benefits your balance sheet and indirectly benefits your customer,” Kestenbaum points out. “The capital that you free up by running an efficient supply chain can be deployed elsewhere in the business. The good news is, technology has reached a stage where you can get that efficiency without adding labor costs.”

Conclusion

2020 has been a year of violent change for consumer economy entrepreneurs and investors.

The challenge and opportunity, as always, is predicting what comes next. Having a digital presence, offering sustainable, cost-effective products, and optimizing supply chains have become imperative focus areas for all businesses operating in the consumer space, whether they were ready for it or not. As we’ve learned over the last 9 months, however, those that improvise and adapt are in a prime position to overcome.

To conclude, we’re excited to present Axial’s 2020 Top 50 Consumer Investors and M&A Advisors, whose efforts in advising and capitalizing consumer industry business owners deserve recognition.

The 2020 Axial Consumer Top 50

How can you improve the value of your business?

Complete the “Value Builder” questionnaire today in just 13 minutes and we’ll send you a 27-page custom report assessing how well your business is positioned for selling. Take the test now:

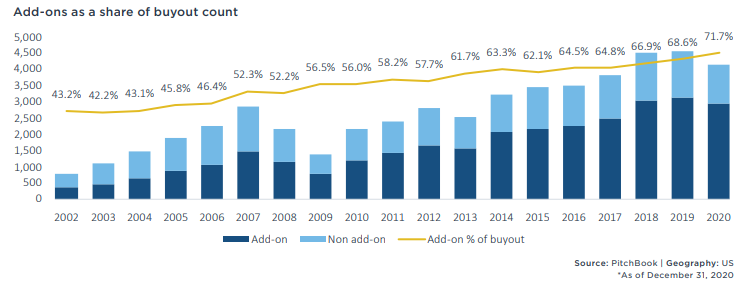

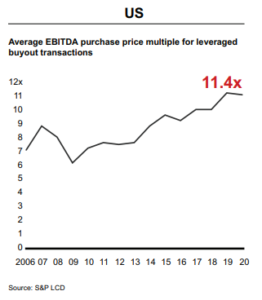

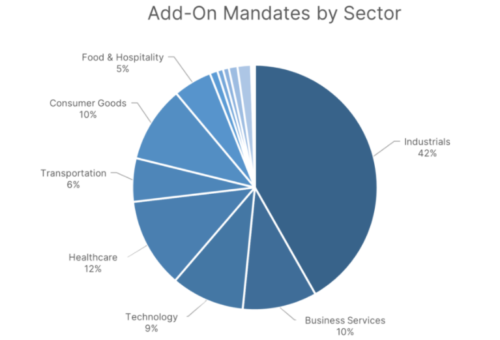

A recent survey of private capital fund managers revealed that 91% of respondents expect there to be a significant hike in asset prices over the next 6 months. This sentiment comes on the heels of an already historically high EBITDA multiple environment, according to data from Bain & Company. After a year rife with uncertainty and economic volatility, investors seem more ready than ever to put their capital to work, contributing to the increase in valuations and competition. Industries such as payments, IT services, and vertical software have been especially competitive due to their insulation from the fallout of COVID-19 and recession proof characteristics. GPs have had to consistently pay up for businesses in these industries, and in turn, are doubling down on inorganic growth strategies to remain competitive.

A recent survey of private capital fund managers revealed that 91% of respondents expect there to be a significant hike in asset prices over the next 6 months. This sentiment comes on the heels of an already historically high EBITDA multiple environment, according to data from Bain & Company. After a year rife with uncertainty and economic volatility, investors seem more ready than ever to put their capital to work, contributing to the increase in valuations and competition. Industries such as payments, IT services, and vertical software have been especially competitive due to their insulation from the fallout of COVID-19 and recession proof characteristics. GPs have had to consistently pay up for businesses in these industries, and in turn, are doubling down on inorganic growth strategies to remain competitive.

Predicting consumer trends has and always will be the name of the game in consumer M&A. Even those with the strongest intuition have been kept on their toes since the onset of the pandemic. McKinsey’s

Predicting consumer trends has and always will be the name of the game in consumer M&A. Even those with the strongest intuition have been kept on their toes since the onset of the pandemic. McKinsey’s  Segments of retail M&A were already on the decline for a number of reasons before 2020,

Segments of retail M&A were already on the decline for a number of reasons before 2020,