Private equity looks very different now than it did during the last bull market. The jury is still out on how long the current run will continue, but as the industry continues to adapt to new regulations and investors’ memory of the recession looms, several trends are coming to shape private equity as it is viewed today versus what it looked like at its prior peak.

By the numbers

As has been widely reported, private equity dry power has reached an all time high, topping $1.2 trillion in March 2015. This is compared to less than $600 billion in December 2005 and roughly $800 billion in December 2006, according to recent figures.

Even so private equity firms invested almost the same amount of capital in 2006 and in 2014. In 2014, however, the total number of deals this capital was deployed across was almost a quarter higher than the number of deals done in 2006.

The number of exits in 2014 (1,250) finally brought the industry over it’s previous record (1,219 in 2007). Total exit value recorded in 2014, however, far outshone what we saw in the last boom cycle ($456 billion versus $354 billion in 2007). Many exits still remain, leftover from the last cycle, and the average holding period for portfolio companies has lengthened from 3.4 years in 2008 to an average of 5.7 years as of year-end.

Last year also marked another year of come back for fundraising. While commingled funds generated $543 billion, $666 billion and $686 billion in 2006, 2007 and 2008, respectively, these figures fell sharply following the financial crisis. 2013 posted $528 billion in fundraising and though 2014 slipped a bit, with an additional $499 billion in their pocket, private equity has exhibited the telltale signs of a recovered asset class.

In all of this, it’s interesting to note that funds are taking longer to close. With institutional investors exercising greater caution than before, digging in on GP’s business development and deal sourcing strategies, the process of raising a fund now takes an average of 17 months.

Winds of change

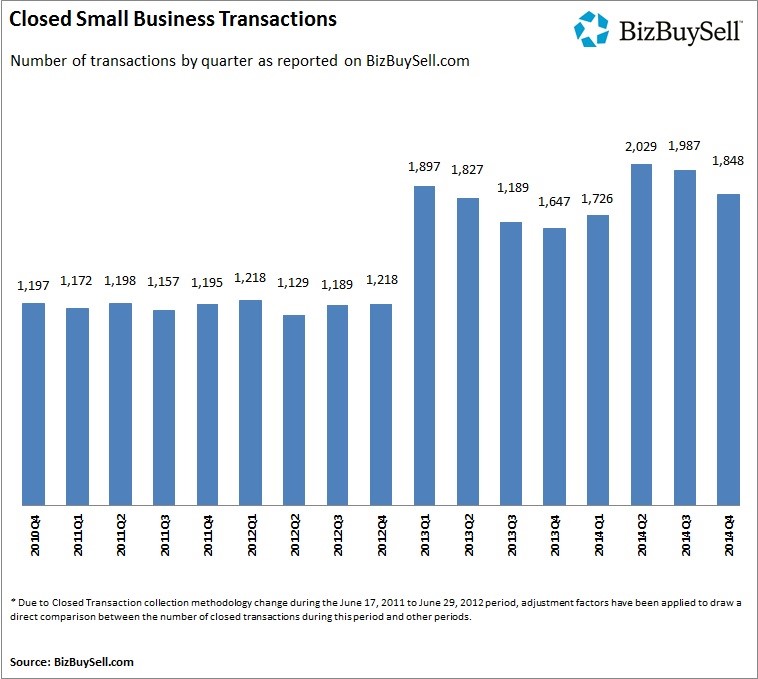

Several emerging trends have come to define private equity in a post-recession, multi-year boom period. While megadeals seemed to be the flavor of choice in the years leading up to the recession, the past year or so has seen a rise in transactions involving small and mid-sized firms. While corporate merger activity is still strong, it’s been reported that sponsors focused on firms with EBITDA between $5 and $30 million are having an easier time obtaining money from institutions, and as such private equity firms across the board have been steadily moving down market.

As firms looking at smaller and smaller businesses, add-on acquisitions and other techniques to grow company value post-acquisition are coming into vogue. In fact, data shows that platform acquisitions fell 23% from 2006 to 2014 and add-on deals surged 63% in that same timeframe. Overall, it’s said that GPs have focused more on adding operational improvements in recent years rather than relying on financial engineering to drive up the value of portfolio companies.

In the core middle market, M&A shows no signs of slowing down. A recent Citizens Bank survey showed that 57 percent of companies with revenue between $100 million and $2 billion were either in the middle of an acquisition or actively seeking such a transaction.

While private equity professionals are facing increased competition from new entrants looking to beat returns of the S&P but avoid the blind pool fund model – we’ve written about family offices taking to direct investments in private companies – they’ve also seen interest in their funds from a new group of investors, high-net-worth individuals. To adjust, many have adopted structures to round up investment from these individuals in addition to their traditional LP profile – pension funds, endowments, and other large institutions. Some big firms have even opted to raise funds specifically for this growing group of individual investors.

Challenges Ahead

We don’t yet know whether 2014 is the next peak of private equity, though some are saying that the party is over. What we do know is that the industry will continue to undergo change and faces some significant challenges in years ahead between rising interest rates, slowed lending for leveraged deals, and continued scrutiny of the industry from a regulatory angle.

Still, there is money to spend, a mounting wave of businesses for sale, in an industry whose core strength is adapting to change and adjusting growth strategy accordingly. As we approach the second half of the year, what we can expect to see is a private equity industry that’s stays on its toes in hopes to see the good times continue.

The above article is provided to VR Business Brokers courtesy of Axial – http://www.axial.net/forum/

If you’ve heard the term EBITDA thrown around and not truly understood what it means, now is the time to take a closer look, as it can be used to determine the value of your business. That stated, there are some issues that one has to keep in mind while using this revenue calculation. Here is a closer look at the EBITDA and how best to proceed in using it.

If you’ve heard the term EBITDA thrown around and not truly understood what it means, now is the time to take a closer look, as it can be used to determine the value of your business. That stated, there are some issues that one has to keep in mind while using this revenue calculation. Here is a closer look at the EBITDA and how best to proceed in using it.

Has the time come where instead of you working for a business, you want to own one? To decide if buying a business is the right decision for you, speak to a VR business intermediary that can help you answer all the pertinent questions.

Has the time come where instead of you working for a business, you want to own one? To decide if buying a business is the right decision for you, speak to a VR business intermediary that can help you answer all the pertinent questions.