By Gary Ampulski, Midwest Genesis

There has been much talk about the strength of the current seller’s market over the next six to twelve months. But how do business owners know that these market conditions will last? Most qualified M&A advisors will tell you that to maximize the value of your company, you have to consider three factors: business optimization, personal readiness, and the state of the capital markets.

Critical Factors that Influence Value

- Business Optimization

This is an internal factor controlled by the owner. It identifies the risk of generating an attractive future earnings stream for the business. Various performance drivers impact investment risk and therefore value through a discounted cash flow projection. Owners can continuously improve the strength of these drivers (planning, leadership, sales, marketing, people, operations, financials, and legal) over time to enhance business value.

- Seller Satisfaction

The second factor, also internal, focuses on how satisfied the seller will be with a potential transaction. Are you ready to sell your business, and what do you want your life to look like after the sale? When thinking about this, sellers should rely on personal financial, estate, tax, and wealth management plans; it’s important to establish the target amount the seller needs to fund his or her lifestyle post-transaction.

- State of the Capital Markets

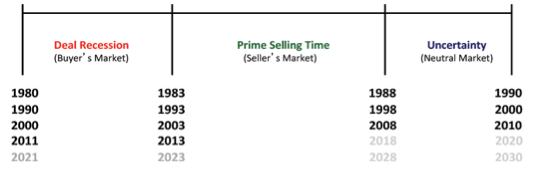

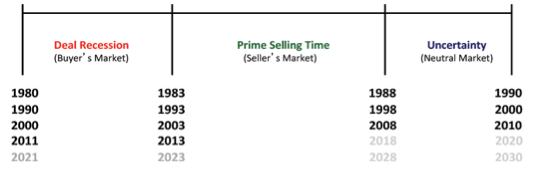

The last component differs from the others in two critical ways. First, the capital markets are outside an owner’s control. They depend on various economic conditions that influence how available funding for an acquisition can generate an acceptable return on the buyer’s investment. The state of the capital markets is cyclical, consistently moving from a “sell” environment, to a neutral or “protect” environment, to a “buy” environment — in that order. These segments repeat approximately every ten years, as illustrated below:

Figure I: 10-Year US Capital Markets Transfer Cycle

The Role of the Advisor

As Yogi Berra once said: “Predicting is really difficult, especially when it’s about the future!” All three factors have multiple dimensions; understanding what drives them is not often top-of-mind for a successful entrepreneur. In fact, if an owner focuses on any of the above factors while trying to run a business, the distraction can put the business and the seller in jeopardy — at a time when both need to be rock solid. The role of an advisor is to identify what needs to be done to optimize each of the internal factors, forecast their outcome, and accurately project the capital market conditions over time to identify an acceptable situation for the seller.

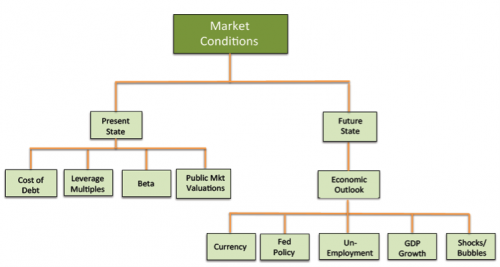

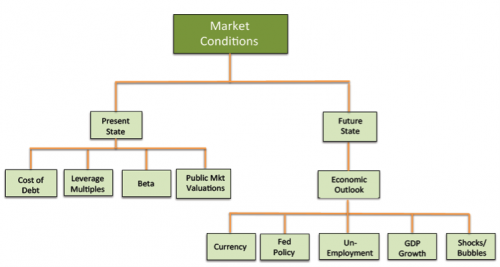

Key indicators drive the transitions between phases in the capital markets. These indicators can improve the accuracy of a market prediction. Wealth management advisors are experts in monitoring and communicating these trends. They formulate opinions on the timing of public market conditions for the benefit of maximizing the return on their clients’ portfolios. Their predictions can also help facilitate a private seller’s transition timing and support the transformation of an entrepreneur (with a highly concentrated, illiquid asset in the business) into an investor (with a properly balanced asset allocation that can be used to fund post-transition needs). The major elements that influence capital market conditions are shown in the chart below.

Figure II: Factors Influencing Capital Markets

Cost of debt, leverage multiples, industry betas, and public company valuations are elements that characterize the current state of the market. The economic outlook provides a perspective on the future state and is influenced by currency, the Federal Reserve policy, unemployment rates, GDP growth, shocks (terrorism, wars, disease outbreaks, etc.), and bubbles (technology, real estate, etc.)

The trick is to be able to accurately predict the economic outlook far enough out into the future to be meaningful for a private business owner, especially if he or she is considering a sale transaction sometime in the next 2-5 years. This is not much of an issue for an investor in public securities, which are normally highly liquid. Wealth advisors rarely bother with making long-term predictions about the market since they are much better at predicting the present and most investors today can act on advice in a fraction of a second. But it normally takes a business owner of an illiquid privately held company 12 months to complete an ownership transfer. By then, depending on where you are in the cycle, things can change dramatically.

The Value Trade-Off

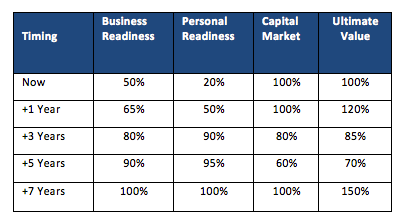

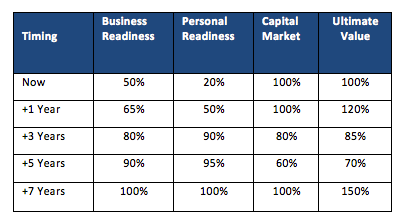

So how do the various business, personal, and market conditions interact to influence value? The table below shows an example of how the strength of these readiness factors can shape value in a qualitative fashion.

Figure III: Relative Impact of Drivers of Business Value

It is not unusual for an owner contemplating a sale transaction today to have a business (three years into the seller’s market cycle) whose quality is half of what it could be, and have little idea of what life after a transition would look like. The value of this business in the current seller’s market might be indexed at 1. With no change in economic conditions over the next year, a seller can enhance value by 20% through a) execution of a solid plan to reduce business risk and b) clarification of funding needs for the next stage of his or her life.

The improvement in value continues until the economic cycle causes a retraction (in this case, year 3) despite advances in business and personal readiness. When the market moves into this segment, the owner has missed the high multiple window and has to wait for a recovery to return value to its previous state. The good news is that during the next seven years, prudent actions on the part of the owner can continue to improve business and personal conditions. As the economy recovers, a huge bump in value can take place for the owner (if the owner has the patience and motivation to wait that long).

Many business brokers and investment bankers promote and respond to the owner’s sense of urgency to capitalize on existing multiples paid for a business. They will often accept sub-optimum business performance or the owner’s undefined personal needs to get a deal done. This may or may not be in the seller’s best interest: It’s a trade-off between cashing in on what you have now versus trying to understand the options and potentially enhancing value in the future. Recognizing that all this takes time, there is risk that the loss of purchase price multiple due to a changing market situation might outweigh any achievable improvement in operating performance. Alternatively, without developing a realistic appreciation for what the business can offer and the personal side of life after a sale, the owner may be reduced to rolling the dice on value and may have a change of heart when the time comes to close.

Advice from Capital Market Analysts

At a recent conference, Jeff Mortimer, Chairman of BNY Mellon’s Wealth Management Asset Allocation Committee, shared his thoughts on today’s M&A environment. Barring a major market shock, Mortimer doesn’t see a good reason that the frothy multiples paid for privately held companies over the last two years will change any time within the next year and a half. But after that, his market model predicts a softening and evolution of the current seller’s market to a “protect” market, then a buyer’s market, which will require perhaps another five years to return to its current seller’s market state.

Given that it takes a year to sell a business, Mortimer’s advice to owners contemplating a sale transaction is “don’t dawdle.” The message is clear: Get some help now to understand your objectives, array your options, evaluate your business, and establish a plan of action. Map this against market conditions and, if appropriate, plan to complete a sale by the end of 2016. After then, Mortimer feels that buyers who are also tracking these market cycles will have pretty good visibility on what their future holds causing multiples to be depressed.

Other investment advisors are saying it might already be too late. Peter Schiff, CEO of Euro Pacific Capital (who predicted the great recession) believes that the US dollar is very overvalued. He anticipates a collapse of the US currency bubble caused by the recent Chinese move to decouple their currency from the dollar. “We’re on the verge of a much worse financial crisis than the one we went through in 2008 and it’s going to take the form of a currency crisis. You’re talking about currency wars. America is going to win the currency war, which is a race to the bottom, and you don’t want to win that war because a currency war is different from most wars in that the object is to kill yourself and unfortunately, we’re going to succeed,” warns Schiff.

To Sell or Not Sell

In about three to six months, an experienced transition-planning advisor can help owners make a well-informed decision if it is better to “sell now” or “hold, grow value, and sell later.” While the owner continues to run the business and improve its profits and cash flow, an advisor can help plan and execute improvements in the business and aspirations of the owner as market conditions evolve. It’s easy for owners to put these kinds of assessments on the back burner in favor of dealing with day-to-day operational issues. But doing so never gets the job done. So, if you are an owner contemplating a sale sometime in the next 2-5 years, the sooner you quantify your options, the more time you will have to execute a solid plan. The cost of delay may be significant. So, follow the advice of top wealth managers: get some help and “don’t dawdle.”

The above article provided courtesy of Axial.com

Would you like to find out how well positioned your business is to be sold now?

Complete the Sellability Score questionnaire today and we’ll send you a 27-page custom report complete with your score on the eight key drivers of Sellability. Take the test now:

Once the decision to sell has been made, the business owner should be aware of the variety of possible business buyers. Just as small business itself has become more sophisticated, the people interested in buying them have also become more divergent and complex. The following are some of today’s most active categories of business buyers:

Once the decision to sell has been made, the business owner should be aware of the variety of possible business buyers. Just as small business itself has become more sophisticated, the people interested in buying them have also become more divergent and complex. The following are some of today’s most active categories of business buyers: If you’re a business owner, do you know how much your business is worth? If you don’t, you’re not alone. The majority of small business owners in today’s market do not know the value of their business. Additionally, there are fewer who have exit strategies in place.

If you’re a business owner, do you know how much your business is worth? If you don’t, you’re not alone. The majority of small business owners in today’s market do not know the value of their business. Additionally, there are fewer who have exit strategies in place.

Many executives of both public and private firms get a physical check-up once a year. Many of these same executives think nothing of having their investments checked over at least once a year – probably more often. Yet, these same prudent executives never consider giving their company an annual physical, unless they are required to by company rules, ESOP regulations or some other necessary reason.

Many executives of both public and private firms get a physical check-up once a year. Many of these same executives think nothing of having their investments checked over at least once a year – probably more often. Yet, these same prudent executives never consider giving their company an annual physical, unless they are required to by company rules, ESOP regulations or some other necessary reason.