By Paris Aden | November 13, 2017

Takeaway: Here are the key areas buyers look at when they are assessing whether or not to acquire your business.

When business owners consider a sale of their company, a common first question is: “How much is my company worth?” The answer is guided by the elements that buyers look for when they assess the value of a business. So, from a buyer’s perspective, what makes a company an attractive acquisition target?

A recent study by Intralinks and the M&A Research Centre at Cass Business School in London provides some answers to this question. Additionally, Paul Eldridge, a partner at Fulcrum Capital Partners, shared insights with us, gleaned from his extensive experience as a private equity investor.

1. Growth

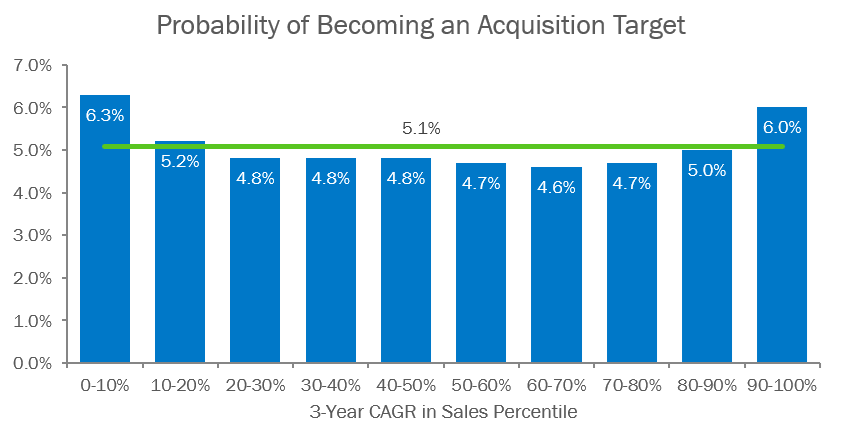

Growth is a leading differentiator for potential buyers. According to the Intralinks study, the three-year compound annual sales growth rate for target companies was, on average, 2.4% higher than that of non-targets.

What if a company has a record of low historic growth, perhaps due to capital constraints, but has exciting future growth opportunities? According to Mr. Eldridge, this type of company may still be an attractive target to a financial buyer if there are “obvious paths to growth and clear execution plans to achieve these growth targets.” This may explain, at least in part, why companies in the bottom decile for growth are actually most likely to be approached as a potential target (see chart below). These companies may also be attractive to strategic (corporate) buyers, if there are cost-reduction and/or revenue synergies to be unlocked.

2. Profitability

Profitability is not to be confused with growth. While some private equity professionals are willing to overlook profitability for solid growth opportunities, historical results suggest that higher profitability is favored by buyers. The Intralinks report found that the profitability of target companies was, on average, 1.2% higher than that of non-targets in the private market.

From a buyer’s perspective, higher profitability reduces the risk of post-transaction operating failure, as well as providing a faster payback period. However, a company struggling with operating losses may be perceived by some buyers as an opportunity waiting to be realized. As Mr. Eldridge told us: “Many private equity investors look for opportunities to add new capabilities to the management team as a path to improving [operating] performance.”

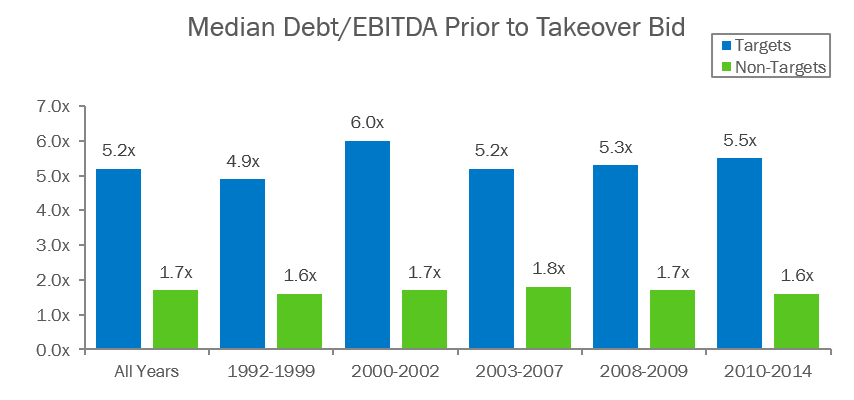

3. Leverage

Private companies with higher leverage are preferred by potential buyers. The chart below illustrates that the average debt/EBITDA ratio for private targets is three times more than non-targets. What is the rationale for this finding? One private equity investor explains it as follows:

“High leverage ratios come at very reasonable valuations…[so] the situation becomes very attractive for us to invest in, provided the business has potential to improve.”

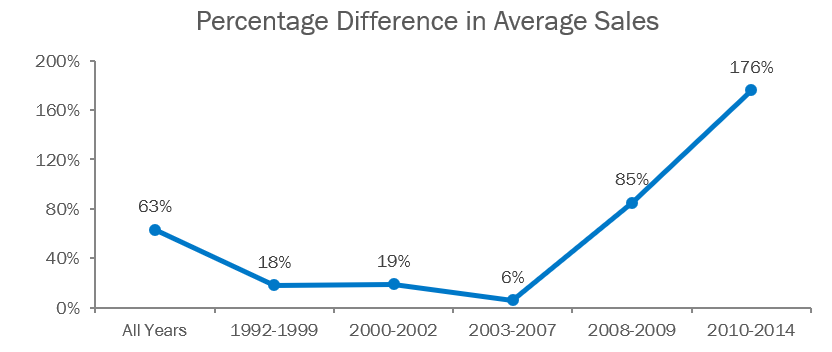

4. Size

Size is a factor for potential buyers, and has becoming increasingly important over the years. Before 2008, the average size difference between target and non-target companies was merely 14%, with size measured in terms of sales. In the years following, the gap widened significantly, and by 2014, target companies were approximately 2.5 times larger than non-targets.

More recently, however, as valuations soar, buyers are setting their sights on smaller companies, which are typically valued at a discount to their larger peers. In fact, predicated on the latest fundraising numbers, a recent Pitchbook article predicts that the next buyout cycle will be “geared towards the middle market, particularly the lower end.”

5. Liquidity

Target companies also tend to have lower liquidity, as measured by the ratio of current assets to current liabilities. Intralinks data indicate that companies in the bottom two deciles in term of liquidity are, on average, 35% more likely to be identified as acquisition targets.

It may go without saying, but we would not recommend pursuing lower liquidity as a strategy to become an attractive target. Lower levels of liquidity are often associated with financial distress, which makes a company more vulnerable as an acquisition target. Under these circumstances, a target with low liquidity is very likely to have a low valuation relative to its peers.

Conclusion

While certain attributes increase the attractiveness of a target, there is no hard and fast rule. Certainly, some buyers look for high sales growth and profitability, as the Intralinks study suggests, but lower performing companies may be attractive as well, albeit at lower valuations. Financial buyers might target these companies if they see an opportunity to create value, improving performance by providing capital or professionalizing management. And strategic (corporate) buyers are likely to target lower performing companies that offer the potential for revenue and cost synergies.

If you are considering a sale of your business, it’s important to understand who your best buyers are. Consider what your company offers a prospective buyer by taking a clear-eyed look at the strengths and weaknesses of your business, and thinking about how different buyers might regard those attributes in their distinct paths to creating value.

Is your business creating maximum value?

Complete the “Value Builder” questionnaire today in just 13 minutes and we’ll send you a 27-page custom report assessing how well your business is positioned for selling. Take the test now: