By John Brown, BEI | July 18, 2017

An increasing number of business owners, many of them aging baby boomers, are seriously considering an exit. According to The BEI 2016 Business Owner Survey Report, 79% are planning to leave their businesses within 10 years.

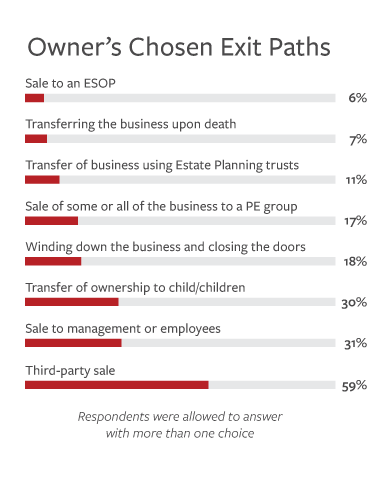

While owners have many exit options to consider, a third-party sale is among the most commonly anticipated. According to the 2016 survey, 59% of owners are considering a third-party sale (Note: These same owners may also be interested in other options).

Like any other exit option, there are numerous advantages and disadvantages to a third-party sale. For owners considering this option, research and preparation are key. Owners who don’t take the time to figure out which path is best for them waste their own time and effort, along with the time and effort of their M&A advisors, trying to carve a path that may not suit their goals.

Is a third-party sale right for your business? Let’s look at the chief reasons owners tend to select or reject a third-party sale.

Advantages

- Risk management: When properly planned, third-party sales are the least risky sale/transfer option, because there’s rarely any doubt that the owner will receive the full sale price.

- Avoiding burnout: Whether owners are tired of working or would rather do something other than work, properly planned third-party sales often allow them to exit sooner than other exit paths.

- No successor needed: A third-party sale is a viable option for businesses where management or children do not want or are not equipped to run the business without the owner.

- Financial security: Well-planned third-party sales typically allow owners to exit their businesses with immediate financial security, a luxury rarely afforded to any other exit path, since third-party buyers typically have the cash necessary to pay owners the full sale price on the day of closing. Insiders, such as children, co-owners, or employees, rarely have the cash necessary to close a sale immediately, often requiring more time or bank financing than the owner or bank is willing to allow.

Disadvantages

- Emotional exhaustion: Third-party sales take time, sometimes more than a year, to complete. Negotiations can spur impatience, leading owners to sell their businesses for less than top dollar or walk away from a deal just to get the process over with.

- Cost: Good investment bankers/business brokers, CPAs, and deal attorneys cost money, sometimes up to or exceeding 10% of the final sale price. Yet, skimping on these advisors can damage long-term sale prospects and result in a lower purchase price.

- Time: The time owners spend trying to sell their businesses is time they could be spending increasing business value. Owners who dedicate too little time to increasing (or at least maintaining) their businesses’ value can find themselves receiving a lower offer than they expected or, in the most extreme cases, having a deal withdrawn altogether. A common mistake that owners make as they commit to a third-party sale is killing time waiting for their big payday, assuming that things will simply fall into place because an outside buyer is taking over. This is less common in insider transfers, since good owners typically understand that they still have work to do to build business value to assure that their internal successor can both run the business and pay the full sale price after the owner exits.

- Market dependence: Today’s M&A market is very robust. But that’s not always the case. It’s much harder to sell a business in a poor economy, as we saw during the Great Recession. Additionally, marketplaces can be brutally harsh to indecisive owners.

In my experience, the best way for owners to know whether a third-party sale is right for them is to assemble a strong exit-planning advisor team. A good advisor will recognize the pros and cons of a third-party sale, and help owners determine whether this option will allow them to leave their businesses when they want, for the money they need, and to the person they choose.

Is your business creating maximum value?

Complete the “Value Builder” questionnaire today in just 13 minutes and we’ll send you a 27-page custom report assessing how well your business is positioned for selling. Take the test now: