Follow the Necessary Steps to a Successful Business Sale

Most business owners, who are looking to sell, make the mistake of not preparing early enough. This can result in not receiving the maximum dollar amount for your business.

The selling process should start when you buy your business. You should know the return that you are receiving on your investment so when the time comes to sell you will not leave any money on the table. In order to consummate a successful sale with a qualified buyer, each VR business intermediary has been trained to help you take the necessary steps. Most business owners should be preparing to sell long before they make the decision to move forward. The following are some helpful ways that will keep your business in good shape, and prepare you for when the time’s right to have your VR business intermediary search for a qualified buyer.

Evaluate Your Business Before the Buyer Does

If you want the buyer to avoid finding anything that could jeopardize your chances of successfully selling your business, you should perform due diligence before they do. A qualified buyer will perform a comprehensive evaluation that goes beyond financial records; therefore, it’s a smart decision to make sure everything is accounted for before presenting the business to them. Make sure that the due diligence covers a variety of different areas such as:

- Operations

- Marketing

- Personnel

- Technology

- Legal

- Regulatory

- Environmental

- Insurance

- Contractual, credit and accounting issues

Every buyer has specific criteria that they are not going to compromise on such as their return on investment. Depending upon the industry, current economic climate and the type of buyer that walks through the door, it’s important to understand what their needs are before negotiations take place. As the seller, you will be able to maximize the likelihood of completing a successful transaction.

Cleaning Up the Balance Sheet

Buyers will always examine balance sheets first after they sign a confidentiality agreement so they can start reviewing the business. You want to avoid revising a balance sheet after this point. By doing so, you will raise concerns from the buyer about the legitimacy of the business’ financial documents, and increase the chance of the deal falling apart. If there is real estate, equipment, copyrights or patents or excess cash that you do not want included in the balance sheet, remove them before a qualified buyer reviews.

Have Your Financials Audited

As a seller, you will put your business in a better position for sale if you have financials audited. This will help add both legitimacy and value in the business to a qualified buyer. They will want to make sure everything financially is accurate and correct through their due diligence, and this will help move the process along. At the very least, a seller should have a credible CPA observe the year-end inventory and file it away if you can’t afford an established auditor. The cost will be minimal, and this often makes a retroactive audit possible if all other financials are in order.

Stable Management in Place

Many businesses have managers assist the owner in its operation. Unless your business is a oneperson show, you must make sure that you have no loose ends when it comes to management. Businesses that appear to operate “fly by night” will not look appealing to prospective buyers. Stable management that has been in place for more than 90 days is important. Many buyers in the market for a business consider management to be one of their top priorities.

Using Comparisons to Better Position Your Company

If you’re shopping in a grocery store, it’s natural to compare different brands of foods to decide which one you’re going to purchase. The same analogy can be used for buyers when it comes to businesses for sale. They will compare similar businesses with yours, so you should maintain a comparison of your financial and operating statistics against those of your competition.

Review sources such as trade associations and bankers’ industry profile books. If you own a business in the middle-market, seek out annual reports. A VR business intermediary will assist you in documenting the facts on your competition and doing an objective comparison of what are the similarities, differences, strengths and vulnerabilities. It should be both understandable by someone not familiar with the industry and believable to one that’s well versed in it.

Publicity Generates Value

Having good and credible publicity clippings will not only help visibility for your business but create value for qualified buyers. In addition to using local and regional press, you can also put yourself in national publications such as Business Week. Many businesses will employ a PR firm or consultant that knows how to generate publicity.

Through VR Business Sales, you will be able to work with advisors who have decades of experience in working with both buyers and sellers in all industries worldwide. We will be able to facilitate the selling process from start to finish, providing you with counsel you can trust.

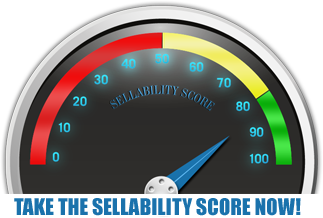

Is your business creating maximum value?

Complete the “Value Builder” questionnaire today in just 13 minutes and we’ll send you a 27-page custom report assessing how well your business is positioned for selling. Take the test now: