BizBuySell’s Insight Report is filled with key statistics and information on a range of topics, including the labor shortage and hiring problems that many businesses currently face. Visit BizBuySell for more information about the findings that they recently reported for the third quarter of 2021. This website also offers an archive of past quarterly reports dating back to 2013.

The pandemic has “reshuffled the deck,” causing many to reassess their positions in corporate America. At this point in 2021, businesses are recovering, but the pandemic continues to play a role in business operations. 71% of business owners surveyed noted that they are facing higher costs than before the pandemic. Most respondents indicated that labor shortages have been having a significant impact on their businesses. There are issues both in hiring and retaining employees.

As the report explains, “According to the U.S. Census Bureau, retail spending in September increased 13.9% over the previous year. However, many businesses still struggle to attract or retain employees. In fact, 49% of owners say the labor shortage is impacting their business, while Business Brokers see it as the number one concern facing small businesses.”

Some of the problems related to the issue of labor shortage are not immediately obvious. As it has become common knowledge that employers are having trouble filling positions and are having to increase pay in order to attract new employees, existing employees are taking note. Since existing employees realize that new hires are being hired at higher wages, they are themselves often expecting raises. In turn, operational costs are going up for many businesses.

The fact is that the business owners are still selling and for a variety of reasons. BizBuySell’s statistics also indicate that of buyers who are planning to sell, 20% cite retirement as their main reason for selling, whereas 38% cite burnout as the primary reason.

According to the data collected by BizBuySell, transactions are up 17% over the last quarter, but are still 7% below pre-pandemic levels. However, it is expected that the number of transactions will grow to be well above their pre-pandemic levels in 2022.

Buyers and sellers alike should remember that the pandemic has changed business and will continue to do so in the near future. In short, the business landscape continues to evolve.

Copyright: Business Brokerage Press, Inc.

The post Current Insights Regarding the Labor Shortage appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

By Ryan Jorden, VR Business Brokers – Managing Partner

By Ryan Jorden, VR Business Brokers – Managing Partner

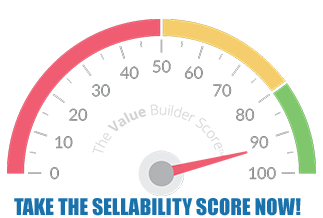

When considering selling your business, every buyer expects a business of great value as an investment. Depending upon the qualified candidate, it could be an entrepreneur with a specific set of needs that motivates them to invest in an established business or it could be a private equity group that sees the benefit in acquiring a business based on their strategy for future growth. Whatever the reasoning might be, the challenge is what can you do to attract the right buyer?

When considering selling your business, every buyer expects a business of great value as an investment. Depending upon the qualified candidate, it could be an entrepreneur with a specific set of needs that motivates them to invest in an established business or it could be a private equity group that sees the benefit in acquiring a business based on their strategy for future growth. Whatever the reasoning might be, the challenge is what can you do to attract the right buyer?