A new decade always comes with a slew of predictions that can be scary. Will a new superbug take hold? Will the stock market crash? Will the economy tank?

These are all excellent questions, but without a crystal ball, you can feel helpless. However, there are three practical steps you can take to inoculate yourself from whatever the coming years will bring:

Inoculation Strategy #1: Stop Trying To Time The Market

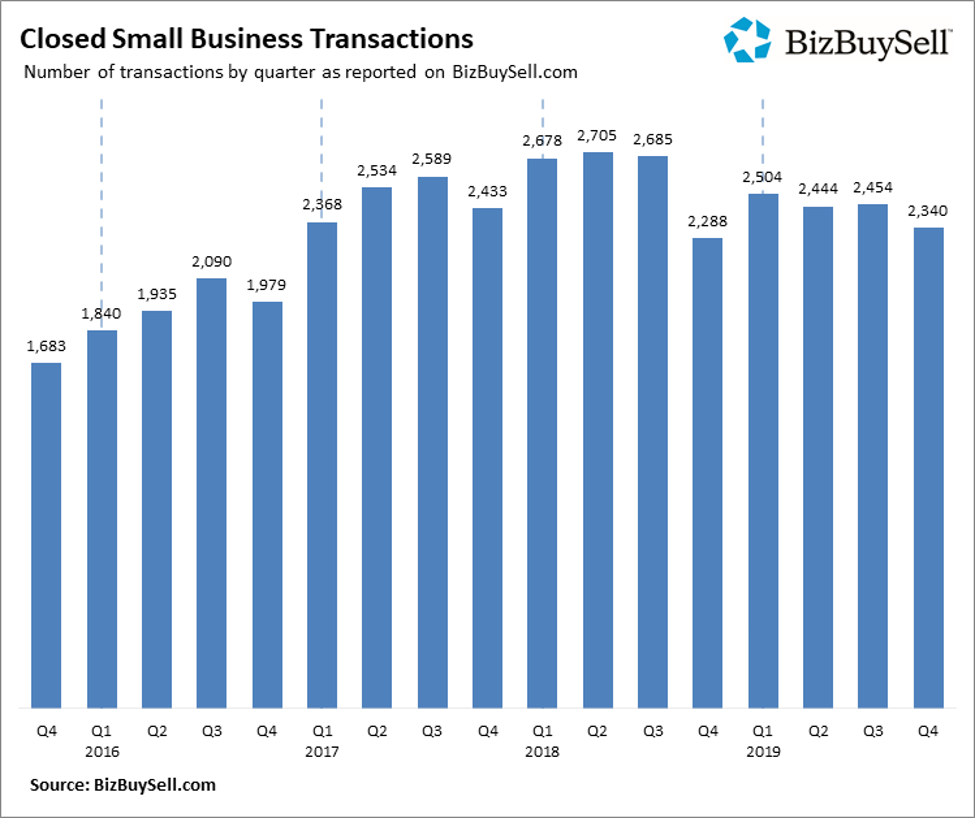

Many founders try to time the sale of their business to coincide with the peak of an economic cycle, reasoning they will get the best price for their business when the economy is booming.

While this is true in theory, when you sell your company, you need to do something with the money. Perhaps you’ll consider investing in real estate or buying stocks. Still, most investments are impacted by the same macro-economic environment your business enjoys, which means you’ll be buying into just as frothy a market.

The alternative to timing the market is to consider selling when your business meets two criteria:

First, if your company is on a winning streak, it will command a premium compared with average performers in your industry. Pick a time to sell when your revenue is growing, gross margin improving, employees are happy, and customers satisfied.

Second never sell before you have all of the information you’ll need to survive due diligence. After you agree to terms with an acquirer, they’ll need some time to verify your business is as advertised. A sophisticated buyer will look into every aspect of your operations, including your financials, customer contracts, employee agreements, the way you produce your product or service your sales and marketing approach and just about every other facet of your business.

You can’t wait until due diligence to prepare this package of information. The volume of questions will suck up too much of your time. React slowly to an acquirer’s request for information and “deal fatigue” will set in. This malaise happens when an acquirer loses interest in closing an acquisition because it is taking too long.

The way to immunize yourself against whatever the economy may be in the years ahead is to sell when you’re on a winning streak, and you have the data assembled to skate through due diligence with ease.

Inoculation Strategy #2: Pick Your Lane

The global economy has been expanding for several years, fueled by low-interest rates and optimistic consumers, which can be a dangerous time for founders. When the economy is hot, it’s tempting to expand outside of your original product and service category as customers seem to be willing to buy just about anything from you.

The problem with diversifying too broadly is that you can become less attractive to an acquirer over time. Acquirers buy what they could not quickly build on their own. When you diversify too broadly, a buyer may pass reasoning, that it would be relatively easy to compete with your similar products or services. They know you’ll want to get paid for all of your business, yet they may only want a small part of it.

Remember that acquirers only buy what they could not quickly build themselves, so they place a premium on buying a business with a definite competitive advantage — for example, a proven brand that consumers prefer or a protected technology innovation.

No matter what the economy has in store for the years ahead, do one thing better than anyone else, and you’ll always have a ready pool of potential acquirers for your business.

Inoculation strategy #3: Create A Vision Board

A vision board is a display of images that illustrate where you want to be in the future. Creating one by grabbing a stack of magazines and cut out pictures that appeal to you and communicate the life you want to lead.

A vision board is a compelling way to immunize yourself from the inertia that sets in once the startup years of your company are behind you. When you’re no longer struggling to find the next customer or wondering how you’ll make payroll, running a business may become less exciting. When you no longer need to draw on your creativity and problem-solving skills, one day may flow into the next, and you can become content, but perhaps not truly happy.

Think about a time when you were happiest. You were probably doing something new, perhaps in a new place with new people, learning, contributing and growing. Most owners are happiest when they are starting and growing a business, but when a company matures, it can become stifling.

The problem is, it can be challenging to leave a successful business. Your lifestyle needs are satisfied through your company, so why go? That’s where a vision board can be handy. It allows you to decipher the difference between being happy and merely content. When you find yourself feeling comfortable but not necessarily happy, that might be the perfect time to sell – regardless of what’s happening in the economy at the time.

Is your business creating maximum value?

Complete the “Value Builder” questionnaire today in just 13 minutes and we’ll send you a 27-page custom report assessing how well your business is positioned for selling. Take the test now: