It is safe to state that Howard Brownstein, President of The Brownstein Corporation, is a true expert in providing turnaround management and advisory services to companies, as well as their stakeholders. Brownstein serves as an independent corporate board member for both publicly held as well as privately-owned companies and nonprofits. During his career, he has been named a Board Leadership Fellow by the National Association of Corporate Directors (NACD) and served as Board Chair and President of its Philadelphia Chapter. He also serves as Vice Chair of the ABA Corporate Governance Committee and has been named a Fellow of the American Bar Foundation. He has been a speaker at many of the world’s top universities including Harvard Business School and Wharton. Brownstein received his J.D. and M.B.A. degrees from the University of Pennsylvania.

Mr. Brownstein is considered to be one of the world’s top experts in distressed businesses. He believes it is essential to remember that not all distressed businesses are, in fact, the same. There is simply no way to know how bad things are for a given distressed business until one begins to “look under the hood,” and get a full view of what problems may lurk underneath.

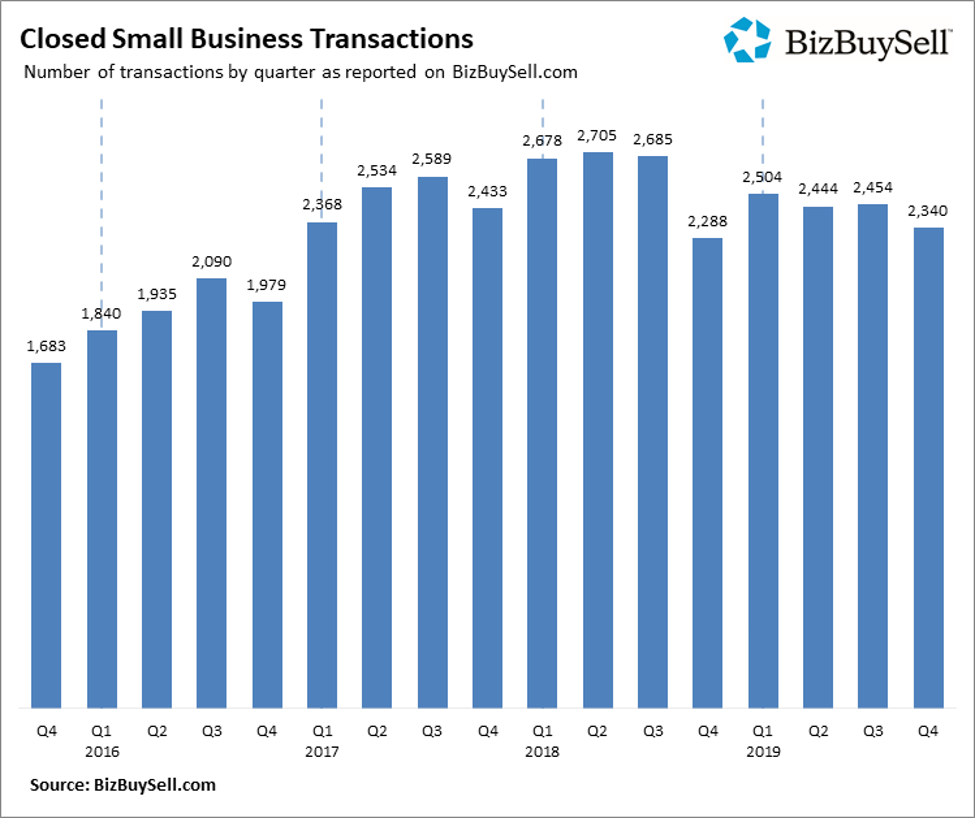

Brownstein firmly believes that distressed businesses can represent a real and often overlooked opportunity for buyers. The recent economic downturn brought about by COVID-19 means that there will likely be a great deal more distressed businesses on the market in the coming months or even in the next couple of years.

Why is a Given Business Distressed?

Before you consider purchasing a distressed business, you absolutely must understand the core reasons for the distresses. Without a proper and detailed understanding of why the business entered a state of distress in the first place, it is impossible to clearly articulate why the business will potentially be valuable in the future. It is essential to be able to convey “what went wrong” and how the problems can be fixed.

Brownstein points out that while there are many reasons for a business to enter distress, two symptoms top the list. The first is cash flow issues and the second issue relates to management. Often it turns out that the management was simply not rigorous enough. He also notes that companies will tend to gravitate to external issues as a way to explain away their failure.

Of course, no two distressed businesses are failing from 100% identical causes. Brownstein suggests a series of questions that you need to ask when you begin exploring a distressed business.

- What is the business’ potential value?

- Is there something of value under the problems?

- Under better or different circumstances, could the business be viable?

These are all questions that your business broker or M&A advisor can assist with. It’s important to gain a clear understanding of the business’ past, present and future.

Copyright: Business Brokerage Press, Inc.

The post Buying a Distressed Business appeared first on Deal Studio – Automate, accelerate and elevate your deal making.