Written by Nick Giacco Axial | May 20, 2021

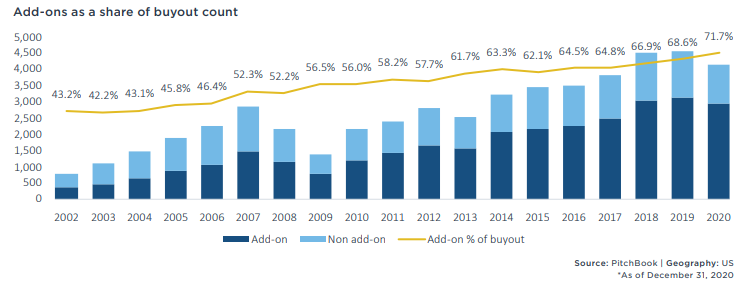

Add-on acquisition activity in the United States has experienced a steady, near linear growth since the early 2000s. In 2002, add-ons accounted for 43.2% of all buyout activity. Last year, add-ons accounted for a staggering 71.7% of all buyout activity – a 65% increase in less than 20 years.

Any trend that spans two decades with the resilience to withstand multiple financial crises deserves attention and further analysis. In this article, we examine a few of the tail winds behind the consistent growth of the buy-and-build strategy. We also feature a list of the most active Axial members and their portfolio companies pursuing add-on opportunities via the Axial platform.

Discounted Deals on the Decline

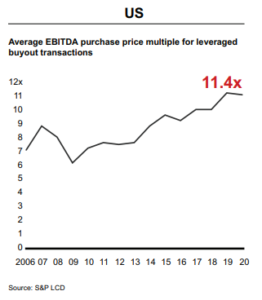

A recent survey of private capital fund managers revealed that 91% of respondents expect there to be a significant hike in asset prices over the next 6 months. This sentiment comes on the heels of an already historically high EBITDA multiple environment, according to data from Bain & Company. After a year rife with uncertainty and economic volatility, investors seem more ready than ever to put their capital to work, contributing to the increase in valuations and competition. Industries such as payments, IT services, and vertical software have been especially competitive due to their insulation from the fallout of COVID-19 and recession proof characteristics. GPs have had to consistently pay up for businesses in these industries, and in turn, are doubling down on inorganic growth strategies to remain competitive.

A recent survey of private capital fund managers revealed that 91% of respondents expect there to be a significant hike in asset prices over the next 6 months. This sentiment comes on the heels of an already historically high EBITDA multiple environment, according to data from Bain & Company. After a year rife with uncertainty and economic volatility, investors seem more ready than ever to put their capital to work, contributing to the increase in valuations and competition. Industries such as payments, IT services, and vertical software have been especially competitive due to their insulation from the fallout of COVID-19 and recession proof characteristics. GPs have had to consistently pay up for businesses in these industries, and in turn, are doubling down on inorganic growth strategies to remain competitive.

Multiple Arbitrage

Multiple arbitrage is one of the most oft-cited reasons and strategies that PE buyers will use to offset the effects of rising valuations. The logic behind multiple arbitrage is fairly straightforward. Larger companies often demand higher EBITDA multiples than smaller ones do. Rolling up a group of smaller, but cheaper companies can therefore more cost effectively increase the net exit value of an investment over time.

Buy-and-build strategies also give GPs access to less competitive segments of the market that would normally be considered too small due to minimum equity check requirements. This approach has shined a light on the lower middle market, specifically companies generating between $5-100M revenue, where there is no shortage of targets to pursue (364,900 as of February 2021).

Data from the Axial Platform

The Axial platform specializes in connecting the lower middle market’s entrepreneurs and their advisors with a diverse group of capital partners. Our unique position in the LMM M&A economy has given us a front row seat to the growth in add-on deal activity over the last few years. Add-on mandates on the platform have grown an average of 55% every year since 2015. 2021 is on pace to record the highest number of net new add-on projects on the platform.

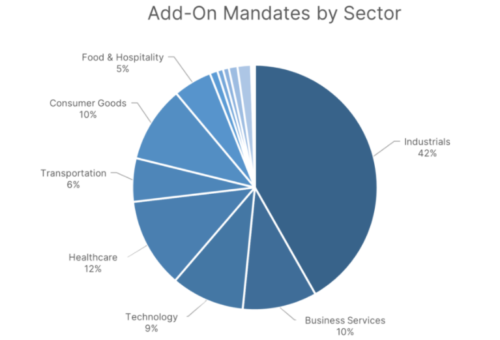

Industry Breakdown

The buy-and-build model traditionally favors any fragmented sector where the sponsor and/or management team at the portfolio company level have expertise in executing and integrating new acquisitions. The pie chart below displays the most popular industries among Axial members currently pursuing add-on acquisitions:

How can you improve the value of your business?

Complete the “Value Builder” questionnaire today in just 13 minutes and we’ll send you a 27-page custom report assessing how well your business is positioned for selling. Take the test now: